The Many Trails...

A newsletter about food systems, climate change and everything connected to them

Hello from Calabria. I decided to take some time off after publishing the Hunger Profiteers investigation and went for this beautiful 3-day hike between the two coasts that sandwich the region.

It was truly stunning, but in hindsight, perhaps walking 75 kilometers over four days wasn’t a great way to recover from a major deadline because I now feel like death. But onwards, with a walking stick!

First, a few thanks

To the publications - and newsletter writers - who have recommended Thin Ink over the past few weeks: The Green Fix, Ana & Al's Big Portuguese Wine Adventure, FutureFeed, Unequal, Movable Worlds and Off-grid and Ignorant in Portugal.

Hello to all the new subscribers from there and elsewhere.

Profiting from Hunger, Part II

Since Lighthouse Reports and media partners published our stories last week, there have been new developments and debates, chief among them is whether speculation is really contributing to rising food prices.

Just to re-iterate, we looked at “excessive speculation” when speculators, instead of market fundamentals such as demand and supply, are setting the price. This is different from the traditional speculation that experts say is useful for hedging against risk and provides liquidity for markets.

Anyway, there were some interesting and thoughtful responses, including this from someone who used to be in the futures market.

And in response to the questions, here is our attempt to have an adult conversation on Twitter, which I know is a challenge, but hey, I don’t think that went badly.

To be perfectly honest, this is all very technical, but I’m sharing here because I really want to make these issues understandable to everyone, because often, keeping some topics ‘specialised’ and ‘technical’ is used to keep people from engaging with the issues.

I’m still learning myself and a lot of the academic literature on this just whooshes me by like an X-wing, so yeah I needed to re-read Lighthouse Reports’ tweets a few times myself to get it.

Still, I think it’s crucial to cover these issues in an accessible way, so here’s me and Kabir Agarwal, a core team member of the investigation and a journalist for The Wire in India, attempting to make sense of it all.

Following our report, foodwatch, an international consumer organisation which produced the excellent 2011 report The Hunger Makers, also released a statement, citing our research and calling for strict regulation of agricultural speculation.

"In the face of looming hunger crises in parts of the world, gambling on agricultural commodity prices is intolerable. Prices are rising because companies and governments fear they will no longer be able to buy enough wheat, sunflower oil or other staple foods. Financial speculators are fuelling the soaring agricultural commodity prices: they are betting on rising prices and hoping for quick profits. Transparency is needed about who has what grain reserves - this is the only way to counter the fear of shortages. The EU urgently needs to set speculation limits and put an end to betting on rising prices.”

- Matthias Wolfschmidt, Strategy Director of foodwatch International

Here’s hoping something will change.

When both humans and nature lose

“When Myanmar’s military staged a coup more than one year ago and seized power from a democratically-elected civilian government, not only did it undo a decade of opening up the country that brought a degree of freedom and prosperity to ordinary citizens, it also condemned the country’s rich biodiversity and ecosystems.”

I wrote an op-ed for The Mekong Eye about how the coup in Myanmar was not only a tragedy for the people but also for the environment.

The country’s citizens are having to live through terrible violence at the hands of the military dictatorship, but the coup regime is also known for its rapacious appetite for natural resource extraction, a key source of income for an isolated country under Western sanctions.

Successive military governments have destroyed pristine forests, polluted waterways and denuded the landscapes through activities like mining, damming and the expansion of large-scale plantations. The profits went into their pockets and the people are left with the consequences of the destruction. It is a vicious cycle that the current junta seems hell bent on continuing.

A triple of interesting reads

1. This piece in Forbes by Michele Simon, a public health attorney, author of Appetite for Profit, and founder of the Plant Based Foods Association, was scathing in her criticism of cell-based meats - aka cultured meat aka lab-grown meat - and said what we need is a change in agriculture policy that will, among other things, discourage factory farms.

“Instead of billions going into synthetic, biotech animal products, we should focus on policy change to address the destructive animal agricultural that created this mess in the first place.”

2. Eater’s Amy McCarthy spoke to Martin Riese, a water sommelier - yes that’s a thing, for this story that you might scoff at in the first instance, but actually has useful tips on what to look for when you’re looking for bottled water.

“Riese tends to avoid brands that market themselves as “purified,” or “vapor-distilled,” largely because they tend to be sourced from public water systems just like the water that comes out of your tap,” she wrote.

“When you stroll down the water aisle, there are a slew of marketing buzzwords like “alkaline,” and “electrolytes” emblazoned on every package. According to Riese, these selling points are almost always just marketing hype.”

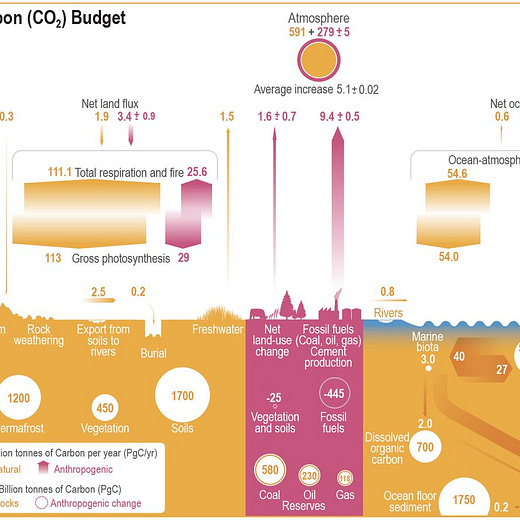

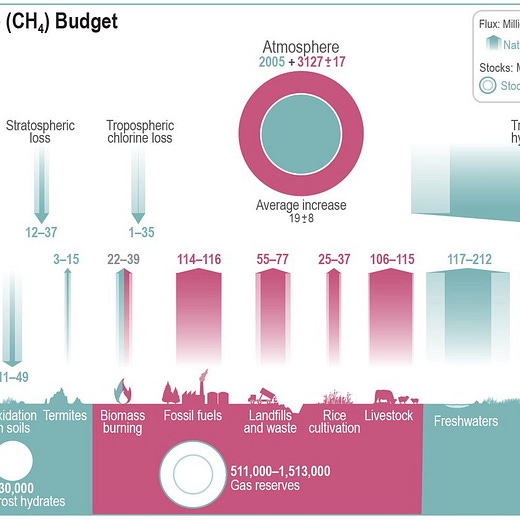

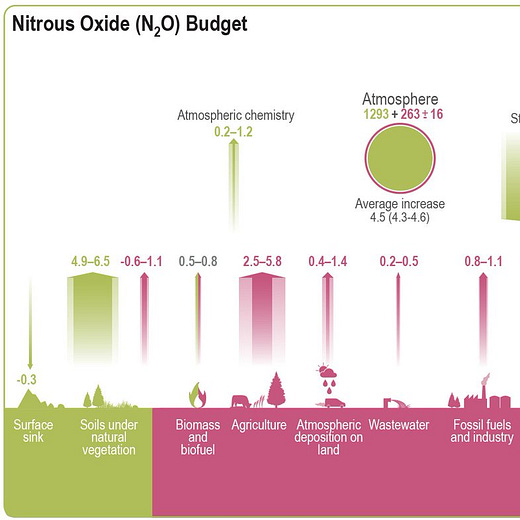

3. I think these tweets from Pep Canadell with very cool illustrations from Nigel Hawtin, about the budgets of the three most important greenhouse gases, are great examples of good science communications, and Pep did a great job of explaining what each illustration means.

Pep is the executive director of the Global Carbon Project and the Coordinating Lead Author on Chapter 5 of the IPCC’s science report published last August.

As always, have a great weekend! Please feel free to share this post and send tips and thoughts on twitter @thinink, to my LinkedIn page or via e-mail thin@thin-ink.net.